A Direct Selling Agent (DSA) is an individual or organization designated by a financial institution, like a bank or insurance company, to find and attract customers for their financial products and services.

NIRA offers opportunities for Direct Selling Agents (DSAs) to partner and earn through the promotion and sale of NIRA’s loan products. Becoming a NIRA DSA partner can be a lucrative venture with various benefits.

|

NIRA DSA Partner Program Highlights |

||

| 1. | Age | DSAs must be over 18 years old. |

| 2. | Citizenship | Applicants must be Indian citizens. |

| 3. | Occupation | Open to salaried individuals, self-employed professionals, and business owners. |

| 4. | Work Experience | No previous experience is required for registration. |

| 5. | Required Skills | Applicants must have proficiency in negotiation, communication, sales, listening, and customer relationship management. |

Features of the NIRA DSA Partner Program

Joining NIRA as a DSA partner with a digital lending platform comes with numerous advantages.

1. Flexible Working Hours- Work at your own pace and convenience without fixed hours, making it ideal for those looking to supplement their income or work part-time.

2. Dedicated Support Team- Get continuous support from NIRA’s team for any queries or issues, ensuring smooth operations and assistance whenever needed.

3. Online Dashboard for Tracking- Use an intuitive online dashboard to monitor your referrals, track loan application statuses, and view your commissions in real-time.

4. No Initial Investment Required- Join the program without any registration fees or initial investments, making it accessible to a wide range of individuals and businesses.

5. Quick and Easy Registration Process- Simple and streamlined registration process with easy document submission and quick approval.

6. Broad Eligibility- Open to a wide range of individuals including salaried professionals, self-employed individuals, and businesses.

7. Potential for High Earnings- With the right efforts and network, there is significant potential for high earnings through consistent referrals and successful loan disbursals.

8. Automated Payouts- Commissions are automatically credited to your registered bank account, ensuring timely and hassle-free payments.

By leveraging these features, NIRA’s DSA Partner Program aims to provide a rewarding experience for partners, while also expanding the reach of NIRA’s financial products.

Eligibility Criteria to Apply for NIRA DSA Partner

The NIRA DSA Partner Program typically requires applicants to meet several criteria. Although the specific criteria can differ, typical requirements include:

- Minimum Age Limit- The partner must typically be at least 18 years old to enter into a contractual agreement.

- Occupation- Business owners, salaried employees, and self-employed professionals are eligible to apply as NIRA DSA partners to earn additional income.

- Educational Qualifications- While professional degrees or certificates are not mandatory, some organizations require a minimum educational qualification, such as a high school diploma or equivalent.

- Work Experience- Although most companies welcome eligible candidates and provide necessary training, some may prefer partners with prior experience in sales.

- Nationality- You must be an Indian citizen to work as a NIRA DSA partner at any of their branches.

- Communication Skills- Strong communication skills are essential for a DSA, as they need to effectively convey information about the products or services they are promoting to customers.

- Credit Score- As a DSA partner, you need an excellent CIBIL score to provide financial advice to others.

Note: You can read this blog to discover practical methods to improve low CIBIL scores. Click here to learn 10 guaranteed methods to boost your credit score rapidly.

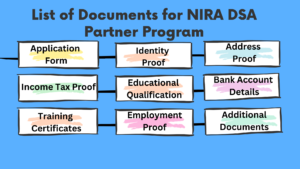

Required Documents for Applying as a NIRA DSA Partner

Here is a list of the essential documents needed to become a NIRA DSA partner:

- Registration Form- Fill out the NIRA DSA application form with your personal and professional information.

- Identity Proof- Provide a PAN Card, Passport, Voter ID Card, or Aadhaar Card.

- Address Proof- Submit utility bills, a driving license, Voter ID Card, Aadhaar Card, or Passport as proof of address.

- Income Tax Proof- Include Form 16 and any other relevant income tax documents.

- Educational Qualification- Some organizations may require proof of your minimum educational qualifications.

- Bank Account Details- A bank account is essential for processing payments.

- Training Certificates- Depending on the direct selling business, you might need to provide certificates or proof of training in sales or marketing.

- Other Specific Requirements- Some companies or organizations may have additional criteria based on their industry, compliance regulations, or internal policies.

- Proof of Employment:

- Business Owners- Provide address proof and a recent bank account statement for your business.

- Self-Employed- Submit financial statements and invoices.

- Salaried Individuals- Provide your latest salary slips.

7 Steps to Apply for the NIRA DSA Partner Program

To apply for the NIRA DSA partner program, you typically need to follow these steps:

Step 1: Visit the NIRA Website- To start your registration as a NIRA DSA, contact the appropriate department or person in charge of DSA partnerships. You can find this information on their website or by making a direct inquiry.

Step 2: Fill Out the Application Form- Complete the online application form with accurate details. This usually includes personal information, business details, and contact information.

| 1. | Personal Information | Name, current address, contact number, and email address. |

| 2. | Professional Information | Occupation, work experience, educational qualifications, and certifications. |

| 3. | Business Details | Business name and address, type of work, and contact details. |

| 4. | Bank Details | Account holder’s name (as per bank records), account number, bank name, and IFSC code. |

Step 3: Submit the documents- After filling out the form, review all the details and submit the application. Ensure all required fields are completed and all documents are uploaded.

Step 4: Screening and Verification- After submission, NIRA will review your application. This may include background checks, verification of documents, and possibly an interview or additional screening process.

Step 5: Agreement and Onboarding- If your application is approved, you may need to sign an agreement or contract with NIRA. Once the agreement is signed, you’ll be onboarded as a DSA Partner.

Step 6: Training and Support- NIRA may provide training sessions to help you understand the products, services, and sales processes. This is an essential step to ensure you can effectively promote NIRA’s offerings.

Step 7: Start Selling- Once onboarded and trained, you can begin your activities as a NIRA DSA Partner, helping customers access NIRA’s financial products.

Frequently Asked Questions (FAQs) for NIRA DSA Partner

Here are some frequently asked questions (FAQs) for the NIRA DSA Direct Selling Agent Partner Program:

1. What is the NIRA DSA Partner Program?

The NIRA DSA Partner Program allows individuals and businesses to earn commissions by referring potential customers to NIRA’s financial products, primarily personal loans.

2. How long does it take to get approved as a NIRA DSA Partner?

After submitting your application, it typically takes a few days for NIRA to review your details and approve your application. You will receive a notification either by email or phone.

3. How will I earn commissions as a NIRA DSA Partner?

You earn commissions based on the number of successful loan disbursements made to customers you have referred. The commission structure may vary depending on the type of product and other factors.

4. What are my responsibilities as a NIRA DSA Partner?

As a DSA Partner, your primary responsibility is to refer eligible customers to NIRA’s financial products. You will need to explain the product offerings to potential customers and guide them through the application process.

5. Is there any training provided for NIRA DSA Partners?

Yes, NIRA provides training and resources to help you understand their products, the referral process, and how to maximize your earnings as a DSA Partner.

Conclusion

Joining as a NIRA DSA Partner provides a valuable opportunity to work with a trusted financial institution while accessing a wide array of financial products and services. By promoting NIRA offerings and delivering top-notch customer service, you can meet the financial needs of your clients. With strong communication channels and support systems in place, NIRA equips its DSA Partners to excel in their sales efforts and cultivate a successful partnership.

You Can Compare Below with Other DSA Partners

- Axis Bank DSA Partner- Complete Details

- Tata Capital DSA Partner Key Highlights

- Bajaj Finserv DSA Partner Registration: Complete Details

- CASHe DSA Partner Program: A Step-by-Step Guide

- Complete Guide: ICICI Bank DSA Partner

- Federal Bank DSA Partner Complete Details

- HDFC Bank DSA Partner

- PaySense DSA Partner Registration: A Comprehensive Guide

- RBL Bank DSA Partner Complete Overview

- IDFC First Bank DSA Partner Key Highlights

- IndusInd Bank DSA Partner Online Registration

- Kotak Mahindra Bank DSA Step-By-Step Guide

- Yes Bank DSA Online Registration: Complete Details

- Standard Chartered Bank DSA partner overview

- Moneyview DSA Partner Registration: Complete Overview

- DMI Finance DSA Partner Step-by-Step Guide

- Piramal Finance DSA Partner Key Highlights

- L&T Finance DSA Partner Complete Details

- Upwards DSA Partner Program: Key Highlights

Thank You for Reading!

Pingback: Nira DSA Partner Online Registration Process | ...