A Direct Selling Agent (DSA) is an individual who partners with lending institutions to market and sell their products. DSAs promote these financial products and earn commissions based on monthly sales. By collaborating with DSAs, financial institutions can expand their reach and delegate various tasks.

As an Upwards DSA partner, you need to assist loan applicants, verify documents, and maintain transaction records. Partnering with a lending institution like Upwards offers the opportunity to develop new skills and the potential to earn significant income.

|

Upwards DSA Partner Key Highlights |

|

| Age Requirement | Partner must be at least 18 years old. |

| Nationality | Applicants must hold Indian citizenship. |

| Occupation | Suitable for salaried individuals, self-employed professionals, and businessmen. |

| Work Experience | No prior experience is required for registration. |

| Required Skills | Negotiation, communication, sales, listening, and customer relationship management skills are essential. |

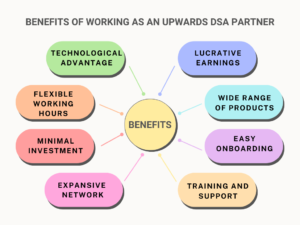

Advantages of Working as an Upwards DSA Partner

Upwards DSA Partner program offers several features for individuals and businesses involved in financial services. Here are some key benefits:

1. Lucrative Earnings- Upwards DSA partner can earn significant commissions by referring clients for personal loans, professional loans, and other financial products. The more referrals made, the higher the potential earnings.

2. Wide Range of Products- Upwards offers a variety of financial products, including personal loans, business loans, and credit lines. This variety allows DSAs to cater to a broader audience and meet diverse client needs.

3. Easy Onboarding- The onboarding process for becoming a DSA partner with Upwards is straightforward and hassle-free, making it accessible for many individuals and businesses.

4. Training and Support- Upwards provides training and ongoing support to its DSA partners. This includes understanding the products, the application process, and effective sales techniques.

5. Technological Advantage- Upwards leverages technology to simplify the loan application and approval process. DSAs benefit from a streamlined, digital platform that enhances efficiency and reduces paperwork.

6. Flexible Working Hours- As a DSA partner, you have the flexibility to work at your own pace and schedule. This is particularly advantageous for individuals looking for a part-time income source or those who prefer remote work.

7. Minimal Investment- Becoming a DSA partner typically requires minimal initial investment, making it an attractive option for those looking to start a business with low capital.

8. Expansive Network- Joining the Upwards DSA network provides opportunities to connect with other financial professionals and expand your business network.

Eligibility Criteria to Apply for Upwards DSA Partner Program

While the specific requirements for becoming an Upwards DSA partner can vary depending on the program, here are some common criteria you might encounter:

- Age Requirement- Most companies require DSAs to be at least 18 years old, though some may have a higher minimum age requirement.

- Educational Qualifications- While professional degrees are not necessary, a high school diploma or equivalent is often preferred.

- Profession- Salaried individuals, self-employed persons, and business owners can apply to work as an Upwards DSA partner for additional income.

- Experience- Some companies may prefer candidates with prior sales experience, particularly in the relevant industry. However, many companies also provide training for new DSAs.

- Citizenship- You must be a citizen of India to work as an Upwards DSA partner in any of their existing branches.

- Essential Skills- Strong communication, selling, and negotiation abilities are vital, as partners must effectively convey product or service information to potential customers.

- CIBIL Score- An excellent CIBIL score is necessary for providing financial advice to others.

Note: To learn how to improve a low CIBIL score, read this article thoroughly. Click here to discover 10 assured ways to improve your credit score quickly.

Documents Required for Upwards DSA Partner Program

To become a Direct Selling Agent for Upwards, you must submit specific documents as part of the registration process:

- Registration Form- Fill out the application form provided by Upwards thoroughly, ensuring all personal and professional details are accurately completed.

- Identity Proof- Submit a copy of one of the following: Voter ID Card, PAN Card, Passport, or Aadhar Card.

- Address Proof- Provide a copy of one of the following documents: Voter ID Card, Aadhar Card, utility bills (electricity, water, gas), Driving License, or Passport.

- Income Tax Proof- You need to submit Form 16 along with other relevant income tax documents.

- Educational Qualification- While higher educational qualifications are not mandatory, some companies may require proof of minimum academic achievements.

- Bank Account- It is essential to have a bank account where your commission will be directly deposited.

- Certificates- Depending on your job’s nature, you may need to provide certificates as proof of training in sales or marketing.

- Proof of Employment Requirements:

- For Businessmen: Provide address proof and a current bank account statement for the business.

- For Self-employed Individuals: Submit financial statements and invoices as proof.

- For Salaried Employees: Present your most recent month’s salary slips.

- Additional Requirements- Some organizations may have additional requirements based on industry standards, compliance regulations, or internal policies.

Steps to Apply for the Upwards DSA Partner Program

Becoming an Upwards DSA partner involves a straightforward online registration process. Here are the general steps to apply for the Upwards DSA partnership program:

Step 1: Reach Out to Upwards- Begin by visiting the official Upwards portal or contacting the designated department responsible for DSA partnerships to start your registration process.

Step 2: Complete the Application- Whether online or offline, fill out the application form accurately with all required details. Submit all necessary documentation as requested by Upwards.

The application form may require the following details about the DSA partner:

| 1. | Personal Information | Full name, current address, contact number, email id |

| 2. | Professional Background | Occupation, years of work experience, educational qualifications, certifications |

| 3. | Business Information | Business name and address, nature of work, contact information |

| 4. | Banking Details | Bank name, account holder’s name (as recorded by the bank), account number, IFSC code |

Step 3: Document Submission- Gather all required documents, including identity proof, proof of address, educational certificates, and any additional documents. Please include these documents with your filled-out application form.

Step 4: Verification Process- Once you have submitted your application and documents, Upwards will review and conduct a background check. Be prepared for this verification process, which may take some time. Additional requirements or inquiries may be requested by the company.

Step 5: Interview Booking- If Upwards shortlists your DSA profile, an interview will be scheduled to evaluate your basic knowledge and understanding of the DSA role.

Step 6: Agreement Signing and Training- Once your application is approved, Upwards will provide you with a DSA agreement. Please carefully review the terms and conditions, and if you agree, please sign the agreement.

Step 7: Start Promoting- After signing the agreement, you can begin promoting Upwards products/services to potential clients. Adhere strictly to the company’s guidelines and ethical standards while representing them.

Frequently Asked Questions (FAQs) for Upwards DSA Partner

Certainly! Here are some frequently asked questions (FAQs) you might consider for Upwards DSA Partner:

1. Who can join Upwards DSA Partner?

Any DSA who meets the eligibility criteria can join Upwards DSA Partner. Typically, this includes individuals or organizations involved in selling financial products like loans, credit cards, insurance, etc.

2. What are the benefits of joining Upwards DSA Partner?

Benefits include access to a wide range of financial products, competitive commission rates, training and development opportunities, marketing support, and a dedicated relationship manager.

3. How do I apply to become a DSA Partner with Upwards?

You can apply online through their official website or contact their customer service for more information on the application process.

4. Is there a minimum sales target or requirement to maintain DSA status?

Typically, there are sales targets or performance metrics that DSAs need to meet to maintain their partnership status. Specific details can be obtained from Upwards DSA Partner program guidelines.

5. How often are commissions paid to DSAs?

Commissions are generally paid on a regular basis, depending on the terms and conditions outlined in the agreement with Upwards DSA Partner.

6. Are there any fees or costs associated with joining Upwards DSA Partner?

Typically, there are no upfront fees or costs to join, but DSAs may be required to adhere to certain operational guidelines or contractual obligations.

7. How can DSAs track their performance and earnings?

Upwards DSA Partner provides a dashboard or platform where DSAs can track their sales performance, commissions earned, and other relevant metrics in real-time.

Conclusion

Becoming an Upwards DSA Partner opens doors to a crucial role in guiding customers with personalized financial solutions. It’s a chance to broaden your professional connections and refine your sales skills.

Whether you’re experienced in sales or new to the financial sector, Upwards provides comprehensive resources and support to maximize your success. Joining as an Upwards DSA Partner marks the beginning of an enriching and dynamic career in financial services. Before starting your registration process, it’s essential to acquaint yourself with details about other DSA partners.

You Can Compare Below with Other DSA Partners

- Axis Bank DSA Partner- Complete Details

- Tata Capital DSA Partner Key Highlights

- Bajaj Finserv DSA Partner Registration: Complete Details

- CASHe DSA Partner Program: A Step-by-Step Guide

- Complete Guide: ICICI Bank DSA Partner

- Federal Bank DSA Partner Complete Details

- HDFC Bank DSA Partner

- PaySense DSA Partner Registration: A Comprehensive Guide

- RBL Bank DSA Partner Complete Overview

- IDFC First Bank DSA Partner Key Highlights

- IndusInd Bank DSA Partner Online Registration

- Kotak Mahindra Bank DSA Step-By-Step Guide

- Yes Bank DSA Online Registration: Complete Details

- Standard Chartered Bank DSA partner overview

- Moneyview DSA Partner Registration: Complete Overview

- DMI Finance DSA Partner Step-by-Step Guide

- Piramal Finance DSA Partner Key Highlights

- L&T Finance DSA Partner Complete Details

Thank You for Reading !

Pingback: Key Highlights of the Lendbox DSA Partner Program - Financial Marketplace | OneSarv

Pingback: Comprehensive Guide to Faircent DSA Partner Registration - Financial Marketplace | OneSarv