A Direct Selling Agent (DSA) is a professional financial advisor who offers a range of products and services to their clients. By registering as a Faircent DSA Partner, they can also provide expert guidance and facilitate loan services for their clientele.

This opportunity is particularly advantageous for professionals like real estate agents, insurance agents, travel agents, and sales agents.

|

Faircent DSA Partner Key Highlights |

|

| Age Requirement | Must be 18 years or older |

| Nationality | Indian citizenship is mandatory |

| Eligible Occupations | Open to salaried professionals, entrepreneurs, and self-employed individuals |

| Experience | No previous experience is required |

| Key Skills | Proficiency in communication, negotiation, sales, active listening, and client relationship management skills |

Key Features or Benefits of Faircent DSA Partner

The Faircent DSA Partner Program supports individuals and organizations in referring clients for loans with key features like:

- Wide Range of Financial Products- Offer a variety of loan and investment options tailored to diverse client needs.

- User-Friendly Platform- Access an easy-to-use digital platform for seamless client and loan management.

- No Prior Experience Needed- Open to individuals with or without prior experience in financial services.

- Flexible Work Environment- Freedom to work at your own pace and schedule.

- Attractive Commission Structure- Earn lucrative commissions for every successful client referral or loan disbursement.

- Exclusive Benefits- Enjoy additional perks such as marketing support, tools, and resources to grow your client base.

- Wide Eligibility- Open to salaried professionals, self-employed individuals, and business owners.

Eligibility Criteria to Become a Faircent DSA Partner

The Faircent DSA partner program is designed to be inclusive, welcoming individuals from various professional backgrounds.

- Age Requirement: Applicants must be a minimum of 18 years old to qualify.

- Nationality: Only Indian citizens are eligible to apply.

- Occupation: Open to salaried professionals, self-employed individuals, and business owners.

- Experience: Prior experience in the financial sector is not mandatory.

- Skills Required: Candidates should possess effective communication and negotiation skills, strong sales and listening abilities, and proficiency in client relationship management.

- Educational Qualifications: While a professional degree is not mandatory, a minimum educational qualification, such as a high school diploma or equivalent, may be preferred.

- Credit Score: A strong credit score is crucial for providing credible financial advice to clients.

Note: If you need guidance on improving your CIBIL score, check out this article for 10 proven strategies to quickly boost your credit score.

Required Documents for Applying as a Faircent DSA Partner

To become a Faircent DSA partner, you need to submit the following essential documents:

- Registration Form- Fill out the Faircent DSA application form with your personal and professional details.

- Identity Proof- Provide any one of the following—PAN Card, Passport, Voter ID, or Aadhaar Card.

- Address Proof- Submit documents such as utility bills, a Driving License, Voter ID, Aadhaar Card, or Passport.

- Income Tax Proof- Include Form 16 and any other relevant income tax-related documents.

- Educational Qualification- Some organizations may require proof of minimum educational qualifications.

- Bank Account Details- A valid bank account is necessary for payment processing.

- Training Certificates- Depending on the direct selling business, you may need to provide certificates or proof of training in sales or marketing.

- Additional Requirements- Some companies may have specific requirements based on industry standards, compliance regulations, or internal policies.

- Proof of Employment:

- Business Owners- Submit address proof along with a recent bank account statement of your business.

- Self-Employed Individuals- Provide financial statements and invoices.

- Salaried Employees- Submit your latest salary slips.

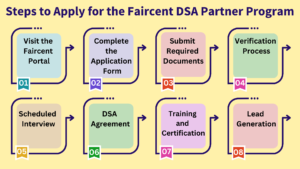

Steps to Apply for the Faircent DSA Partner Program

Faircent offers a quick and convenient online registration process for becoming a DSA Partner. Follow these steps to complete your registration:

Step 1: Visit the Faircent Portal- Access the official Faircent registration portal to initiate the DSA partner registration process.

Step 2: Complete the Application Form- Fill in the required details accurately in the registration form. Providing precise information helps speed up the verification process.

Step 3: Submit Required Documents- Upload all necessary documents along with the registration form. Ensure they are correct, clear, and in the prescribed format.

Step 4: Verification Process- Faircent will review your submitted information and conduct a background check as part of the verification process. They may also request additional documents if needed.

Step 5: Scheduled Interview- If your profile is shortlisted, the bank will arrange an interview to assess your understanding of the DSA role.

Step 6: DSA Agreement- Carefully review the agreement before signing to ensure you understand all your rights and responsibilities.

Step 7: Training and Certification- Faircent may provide training based on the products and services you will be selling to familiarize you with their offerings and processes.

Step 8: Lead Generation- Once onboarded, you can start reaching out to potential customers to promote and sell available products or services, initiating the lead generation process.

Why Become a Faircent DSA Partner?

- Earn attractive commissions on loan disbursements.

- Offer your customers the best loan deals, up to 4% lower than Banks or NBFCs.

- No deposit or investment is required to join.

- Receive comprehensive training on products and services.

- Gain certification as a partner with India’s largest NBFC-P2P lending platform.

- Get continuous support from a dedicated relationship manager.

- Access your own online dashboard to track referrals and leads in real-time.

Frequently Asked Questions (FAQs) for Faircent DSA Partner

Here are some common questions typically asked by individuals applying to become a DSA partner:

1. Who can become a Faircent DSA Partner?

Anyone with a network of potential borrowers or lenders—financial advisors, freelancers, agents, or business owners—can join the program and start earning commissions.

2. How do I register as a Faircent DSA Partner?

You can register online through the Faircent website by filling out the DSA partner application form and completing the verification process.

3. What is the Faircent DSA Partner Program?

The Faircent DSA (Direct Selling Agent) Partner Program allows individuals and businesses to earn commissions by referring borrowers and lenders to Faircent, India’s leading P2P lending platform.

4. When will I receive my commission?

Commissions are typically processed monthly and credited to your registered bank account after successful loan disbursement or lender investment.

5. How can I track my referrals and earnings?

Faircent provides a dashboard where DSA partners can monitor their referrals, loan status, and commission earnings in real-time.

Conclusion

Becoming a Faircent DSA Partner unlocks numerous opportunities for loan agents. This comprehensive DSA guide provides a step-by-step overview of the online registration process. The process is straightforward, and partnering with this brand can pave the way for career growth while offering multiple opportunities to enhance your skills and knowledge.

You Can Compare Below with Other DSA Partners

- Axis Bank DSA Partner- Complete Details

- Tata Capital DSA Partner Key Highlights

- Bajaj Finserv DSA Partner Registration: Complete Details

- CASHe DSA Partner Program: A Step-by-Step Guide

- Complete guide to registering as a MoneyWide DSA Partner

- Complete Guide: ICICI Bank DSA Partner

- NIRA DSA Partner Online Registration Process

- Federal Bank DSA Partner Complete Details

- Comprehensive Guide to Finnable DSA Partner Registration

- HDFC Bank DSA Partner

- PaySense DSA Partner Registration: A Comprehensive Guide

- RBL Bank DSA Partner Complete Overview

- Key Highlights of the Lendbox DSA Partner

- IDFC First Bank DSA Partner Key Highlights

- IndusInd Bank DSA Partner Online Registration

- Kotak Mahindra Bank DSA Step-By-Step Guide

- Yes Bank DSA Online Registration: Complete Details

- Standard Chartered Bank DSA partner overview

- Moneyview DSA Partner Registration: Complete Overview

- DMI Finance DSA Partner Step-by-Step Guide

- Piramal Finance DSA Partner Key Highlights

- L&T Finance DSA Partner Complete Details

- Upwards DSA Partner Program: Key Highlights

Thank You for Reading!